Is Your Business Covered? An Easy Guide to SME Insurance

Protect your café or restaurant from unexpected setbacks with the right SME insurance. This simple guide breaks down what coverage you need and how to choose the best plan for your business.

Running a small or medium enterprise (SME) in Singapore comes with countless responsibilities—from managing operations to serving customers and growing your business. Yet one critical aspect that many business owners overlook is comprehensive business insurance coverage. According to the QBE Singapore SME Survey 2024, 77% of small and medium-sized enterprises expressed moderate to high concern about potential income loss due to business interruptions, yet only 22% had policies in place to cover such events.

Understanding the insurance requirements for Singapore SMEs doesn't have to be complicated. This guide simplifies the essentials of SME insurance Singapore, helping you protect your business, employees, and assets without the confusion.

Why SME Insurance Matters

Small business insurance isn't just about ticking boxes—it's about safeguarding everything you've built. Without adequate SME coverage, a single incident could wipe out your business assets and personal savings. Whether it's a fire damaging your premises, an employee injury, or a customer claiming damages, the financial consequences can be devastating for businesses without proper protection.

The business environment in Singapore is competitive and dynamic. As technology advances and business models evolve, new risks emerge constantly. From cybersecurity threats to supply chain disruptions, SMEs face challenges that previous generations of business owners never encountered. While Work Injury Compensation Insurance is the primary mandatory coverage for most employers in Singapore (with some sector-specific requirements for certain industries), comprehensive insurance coverage beyond the minimum legal requirements provides the financial security and peace of mind that allows you to focus on what matters most: growing your business.

Types of Essential Insurance for Singapore SMEs

1. Work Injury Compensation Insurance

This is mandatory business insurance in Singapore for all employers under the Work Injury Compensation Act (WICA). According to the Ministry of Manpower (MOM), you are required by law to purchase work injury compensation insurance for:

- All employees doing manual work, regardless of salary level

- All employees doing non-manual work and earning S$2,600 or less per month

This work injury compensation insurance compensates employees for medical expenses, medical leave wages, and lump-sum payments for permanent incapacity or death arising from work-related injuries or illnesses. Employers who fail to maintain adequate coverage face serious penalties: a fine of up to S$10,000 and/or imprisonment for up to 12 months for a first offence, as outlined in the MOM's WICA Guide for Employers.

2. Public Liability Insurance

While not legally mandatory in most cases, public liability insurance is essential for businesses that interact with the public or operate from commercial premises. Many landlords and commercial property managers often require proof of public liability insurance as a condition of the lease, making it a practical necessity for most businesses operating from rented premises.

This coverage protects your business against claims from third parties who suffer injuries or property damage due to your business operations. For instance, if a customer slips and falls in your shop, or your employee accidentally damages a client's property while making a delivery, public liability insurance covers the legal costs and compensation claims.

Coverage typically extends to bodily injuries, property damage, and legal defence costs. For businesses in high-traffic sectors like retail, food and beverage, or hospitality, substantial coverage limits—often ranging from S$1 million to S$5 million—are recommended to adequately protect against potential claims.

3. Property Insurance

Your business premises, equipment, stock, and fixtures represent significant investments. Property insurance protects these assets against accidental loss or damage from events such as fire, theft, flooding, or other perils. This coverage can be arranged on either an "All Risks" basis (comprehensive coverage against any accidental damage unless specifically excluded) or a "Fire and Extraneous Perils" basis (covering specific named risks).

For businesses holding inventory, property insurance should include coverage for stock-in-trade. If you operate from rented premises, you'll still need to insure your business contents, including furniture, equipment, renovations, and inventory, even if the building structure itself is covered by your landlord's insurance.

4. Business Interruption Insurance

Often overlooked but critically important, business interruption insurance covers loss of income when your business operations are disrupted. Standard business interruption coverage is typically based on loss of gross profit or increased costs of working, calculated according to your actual financial losses. This coverage usually requires physical damage from an insured peril (such as fire or flood) to trigger, though some policies offer extensions for non-damage business interruption events—a vital component of comprehensive business insurance packages in Singapore.

Some SME insurance packages also include a daily-benefit payout as an alternative or supplement to standard business interruption coverage. Examples include fixed payments of S$200 per day for up to 100-150 days following a covered interruption event. This financial cushion can help cover ongoing expenses like rent and salaries while you recover from the incident.

5. Cyber Liability Insurance

In today's digital economy, cyber threats pose significant risks to businesses of all sizes. Data breaches, ransomware attacks, and system failures can result in substantial financial losses, regulatory fines, and reputational damage. Cyber liability insurance covers costs associated with data breaches, including credit monitoring services, legal fees, notification costs, and recovery actions—making it an increasingly essential part of modern SME insurance Singapore portfolios

Aside: Consider leveraging IMDA's Productivity Solutions Grant (PSG), which subsidises cybersecurity software and tools—though not insurance premiums—to complement your cyber insurance policy. Using PSG-supported cybersecurity solutions alongside comprehensive cyber coverage creates a robust digital protection strategy for your business.

Additional Coverage to Consider

Beyond the essentials, several other insurance types may be relevant depending on your business operations:

- Professional Indemnity Insurance: Covers claims arising from professional errors, negligence, or faulty advice, particularly important for service-based businesses

- Product Liability Insurance: Protects against claims related to injuries or damage caused by products you manufacture, distribute, or sell

- Directors and Officers Liability Insurance: Protects company leaders from personal liability for business decisions

- Employee Benefits Insurance: Group health and medical insurance helps attract and retain quality staff in Singapore's competitive labour market

How Stack-EZ Can Help

As you build and scale your business in Singapore, having the right technology infrastructure is just as important as having proper insurance coverage. Stack-EZ by Singtel offers a comprehensive marketplace where SMEs can access technology solutions tailored to their needs, including business connectivity, point-of-sale systems, and operational tools.

For instance, reliable broadband connectivity solutions help ensure your business stays connected and operational 24/7, reducing the risk of interruptions. Modern retail and F&B businesses can benefit from integrated point-of-sale (POS) systems that help manage inventory, sales, and customer relationships efficiently, reducing operational errors that could lead to losses.

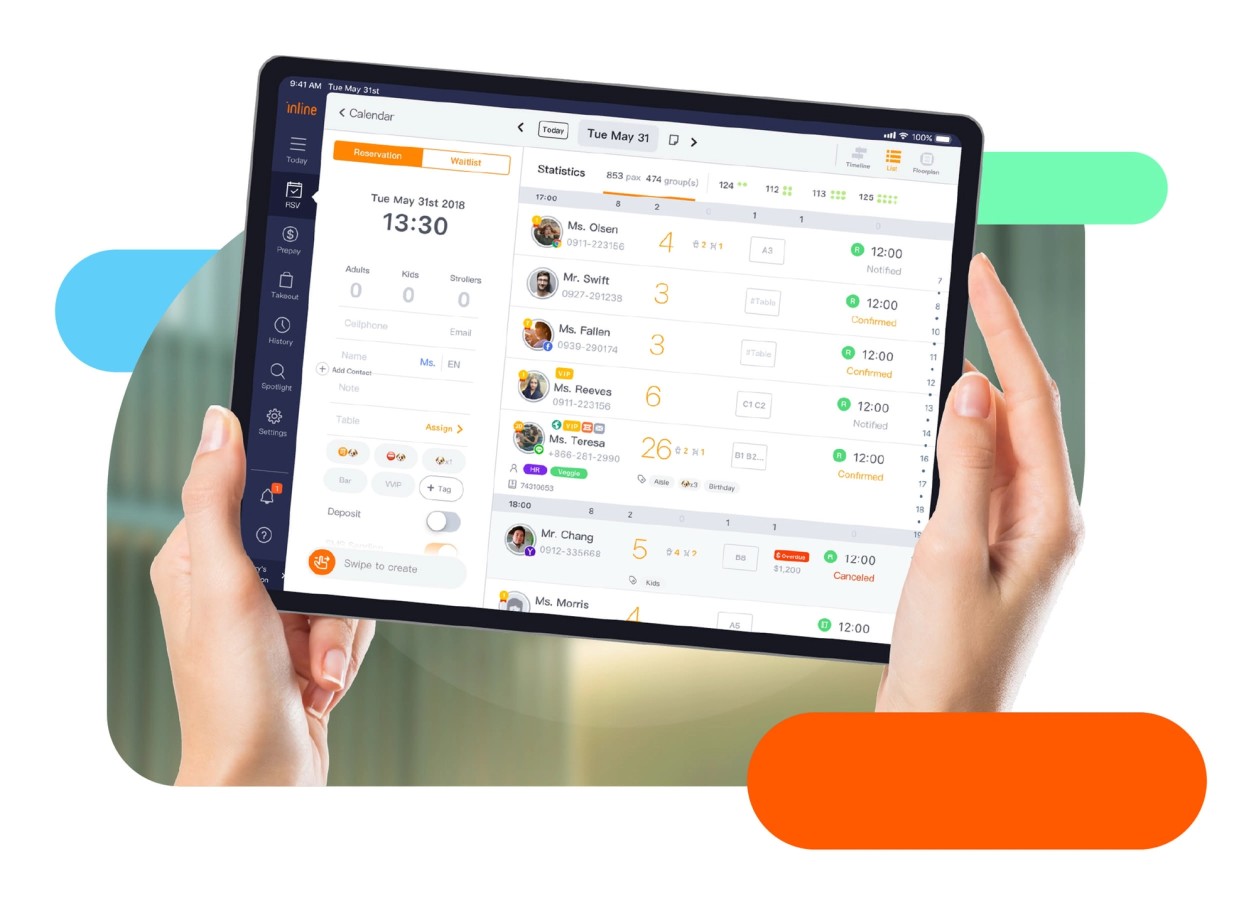

For food and beverage establishments, reservation management apps can help manage bookings, tables, and guests with ease. These operational efficiencies not only improve customer experience but also reduce the likelihood of incidents that could trigger insurance claims.

Note: Product availability and pricing for solutions like eVolve Broadband, EPOS, and Inline may vary. Check the Stack-EZ for current offerings and promotions.

Making Smart Insurance Decisions

When selecting insurance for your SME, consider these practical tips:

- Assess Your Risks: Different industries face different risks. A café faces different challenges than a consultancy firm or a retail shop. Conduct a thorough risk assessment specific to your business operations.

- Don't Underinsure: While it's tempting to choose the lowest premiums, inadequate coverage can be more expensive in the long run. Ensure your coverage limits reflect the actual value of your assets and potential liabilities.

- Bundle Policies: Many insurers offer package policies that combine multiple coverages at discounted rates. These bundles typically cost less than purchasing individual policies separately.

- Review Regularly: As your business grows and evolves, so do your insurance needs. Review your coverage annually and after significant business changes.

- Work with Professionals: Insurance brokers who specialise in SME coverage can help identify gaps in your protection and find cost-effective solutions tailored to your industry.

The Bottom Line

Insurance might seem like an expense when cash flow is tight, but it's actually an investment in your business's future. When considering how much does SME insurance cost Singapore businesses, the answer varies: comprehensive coverage typically costs a few hundred to several thousand dollars annually—a fraction of what you'd face in uninsured losses from a single significant incident.

Recent developments have made business insurance more accessible than ever. Some insurers now offer WhatsApp-based quotation systems, allowing SMEs to obtain coverage quickly and conveniently. Premium costs can range from as low as a few dollars a day to several hundred dollars monthly for comprehensive coverage, depending on your business size, industry, and coverage needs.

By combining proper insurance coverage with the right technology solutions from platforms like Stack-EZ, Singapore SMEs can create a robust foundation for sustainable growth. Don't wait until disaster strikes—assess your insurance needs today and ensure your business is properly protected.

Related Articles

Boosting Supplier Resilience: A Practical Guide for Small Businesses in Singapore

Strong supplier relationships are vital for smooth operations and healthy profit margins. Learn how effective supplier management can help small retailers and F&B businesses in Singapore ensure consistency, quality, and growth.

Delegation for Founders: Avoiding Burnout in F&B and Retail

Founders are driven and resilient, but even the toughest can face burnout. Learn why entrepreneurs are vulnerable, how to spot the signs early, and what steps can help restore balance and focus.

3 Restaurant Tasks You Can Automate Today

Running a restaurant in Singapore means juggling many moving parts amid rising costs and competition. Automation can ease the load—boosting efficiency, cutting costs, and letting staff focus on what matters most.

Accelerate Your Business

All-in Business 5G+ SIM Only Plan

Made Easy and Secure

Keep connected to your business in SG and overseas securely with roaming data & mobile protect.

Customer Engagement

Made Easy

Engage and identify your best and most profitable customers to boost retention.

Table Management

Made Easy

From first click to final bill, manage bookings, tables, and guests with ease.