Government Funding Made Simple: A Quick PSG Grant Guide

Unlock government support with ease — the PSG Grant can help fund your F&B business setup and digital solutions. Here’s a quick guide to help you apply confidently and maximize your benefits.

If you’ve ever held off upgrading your POS system or website because of cost — you’re not alone. The good news? The Singapore government wants to co-fund up to half of that digital transformation for you through the Productivity Solutions Grant (PSG).

What Exactly is the Productivity Solutions Grant (PSG)?

The Productivity Solutions Grant (PSG) represents a significant opportunity for SMEs looking to modernize their operations. It can cover up to 50% of costs for eligible IT solutions and equipment, effectively reducing the financial barrier SME owners face when adopting essential business tools like accounting software, customer management systems, and inventory tracking platforms.

Launched in April 2018, the PSG is the government's way of helping Singaporean SMEs adopt technology without bearing the full financial burden. PSG provides up to 50% support to eligible businesses for pre-approved solutions.

What makes PSG particularly attractive is its simplicity. The grant focuses on pre-approved solutions that have been vetted for quality and effectiveness, which means less paperwork and faster approval times for business owners. Most applications are processed within 4-6 weeks, allowing you to implement the technology your business needs without lengthy delays.

Your Eligibility Checklist

Before you apply, make sure your company meets all the following conditions:

1. Company Criteria

- Registered and operating in Singapore

- At least 30% local shareholding, held directly or indirectly by Singapore Citizens or Permanent Residents

- Group turnover ≤ S$100 million or ≤ 200 employees

2. Solution Usage

- The purchased or leased solution must be used in Singapore (not for overseas operations)

3. Payment Timing

- Do not make any payment or deposit to the vendor before submitting your PSG application Doing so will automatically disqualify your claim.

4. Who’s Not Eligible

- Charities, IPCs, religious entities, VWOs, government agencies or subsidiaries, and societies

Tip: Always confirm with your vendor that your quotation and implementation plan comply with EnterpriseSG’s PSG terms before you submit your application.

Your Step-by-Step Application Roadmap

Applying for the PSG grant might seem daunting at first, but the process is straightforward. Here's how to navigate it successfully.

Step 1: Check Your Eligibility

Before you dive in, make sure your business meets the PSG eligibility criteria. You'll need to be registered and operating in Singapore with the required local shareholding. Check the official requirements to confirm your company qualifies before moving forward.

Start by visiting GoBusiness, the official government portal. Navigate to the Grants and Support section and click on the PSG section. There you can click on "PSG Solutions Directory" to view the comprehensive list of pre-approved solutions. You'll find options ranging from accounting software to inventory management systems, customer relationship management tools to digital marketing services.

Step 2: Choose Your Solution

This is where Stack-ez helps streamline the process. Browse the pre-approved solutions on our platform and select the ones that match your business needs. Stack-ez gives SMEs an advantage ensuring solutions are already vetted by the government, so you won't waste time on applications that might get rejected.

Look for tools that solve your most pressing operational challenges—whether that's managing inventory, tracking finances, or handling customer relationships.

Pro Tip:

Filter by industry and solution type to find what’s relevant for your business. These are pre-approved solutions, so you skip the heavy paperwork.

Step 3: Submit Your Application

Once you've selected your solution, it's time to apply through the Business Grants Portal (BGP). You'll need your CorpPass to log in. The application asks for basic company information and details about the solution you're purchasing. Don't worry about crafting the perfect proposal—since you're choosing pre-approved solutions, the paperwork is minimal compared to other grant programs.

Pro Tip:

Label your documents clearly and check that your UEN and company name match across all files. Mismatches will delay processing.

Step 4: Wait for Approval (Typically 4-6 Weeks)

After submission, the relevant agency will review your application. Most PSG applications are processed within 4-6 weeks. During this time, you might receive questions or requests for additional information. Respond promptly to keep things moving.

You can check your application status anytime through the BGP portal.

Step 5: Implement Your Solution

Once approved, you can move forward with purchasing and implementing your chosen solution.

This is where Stack-ez's onboarding support becomes invaluable, helping you get set up and running smoothly so you're not left figuring things out alone.

Step 6: Submit Your Claims

After implementation, you'll need to submit proof of payment and completion through the BGP portal. Keep all invoices, receipts, and evidence of the solution being deployed in your business.

Once your claim is approved, payment will be made via PayNow Corporate or GIRO within ~14 working days. Then, the grant disbursement (up to 50% of qualifying costs) will be transferred to your company's bank account.

While the process takes some time, remember you're getting the government to co-fund half of your business technology investment—it’s well worth the effort.

Quick Reference Timeline

| Step | Action | Estimated Timeline | Key Reminder |

| 1 | Browse PSG Solutions | 1 - 2 days | Choose pre-approved vendor |

| 2 | Get Quotation | 3 - 5 days | Must match PSG package |

| 3 | Prepare Documents | 1 week | Align company details |

| 4 | Submit via BGP | 1 day | Check all uploads |

| 5 | Approval Process | ~ 6 weeks | Respond fast if queried |

| 6 | Claim & Receive | 2 - 4 weeks | Ensure 1 month usage |

5 Common Rejection Reasons (And How to Avoid Them)

Understanding why applications fail can save you time and frustration. Here are the top reasons for PSG rejections:

- Premature Payment

Many applications are rejected because businesses unknowingly partner with unapproved vendors, assuming their reputation is sufficient to qualify for the grant. Always verify vendor status on the official portal before engaging them. - Documentation Errors

Inconsistencies raise red flags during evaluation and may lead to further inquiries or rejections. Ensure your company name, UEN, and all details match exactly across all documents. - Incomplete Applications

Incomplete applications will be rejected, and applicants may re-apply with all the complete set of required information. Submit everything in one go rather than piecemeal. - Quote Misalignment

Mismatches between project descriptions and quotations can delay approval or result in rejection. Work closely with your vendor to ensure the quotation precisely matches the pre-approved solution specifications. - Eligibility Issues

Common reasons for rejection include businesses exceeding the revenue threshold of SGD 100 million or employing more than 200 employees. Verify your eligibility before starting the application process.

PSG vs Other Grants: Making the Right Choice

Singapore offers several business grants, and choosing the right one matters. Here's how PSG compares:

PSG vs EDG (Enterprise Development Grant)

The Enterprise Development Grant is broader in scope than the PSG grant. EDG accommodates more tailored projects and complex transformations. The application and approval process is more involved, requiring detailed proposals.

For more information on EDG, visit the Enterprise Development Grant page.

PSG vs Startup SG

Startup SG focuses on innovative startups with high growth potential, offering various programmes including:

- Startup SG Founder: Provides S$20,000-S$50,000 grants plus mentorship for first-time entrepreneurs

- Startup SG Tech: Offers up to S$400,000 for Proof-of-Concept and S$800,000 for Proof-of-Value projects

- Startup SG Equity: Co-investment schemes with third-party investors

Startup SG programmes are suited for innovative, technology-driven companies with commercially viable IP (Intellectual Property). If you're a new business with an innovative idea, explore Startup SG. If you're an established SME wanting to digitalise operations, PSG is your better option.

PSG vs MRA (Market Readiness Assistance)

The Market Readiness Assistance (MRA) Grant from Enterprise Singapore helps companies expand into new overseas markets by supporting:

- Overseas market promotion (capped at S$20,000)

- Overseas business development (capped at S$50,000)

- Overseas market set-up (capped at S$30,000)

MRA provides up to 50% funding support, capped at S$100,000 per company per new market. If you’re thinking about expanding overseas, MRA might be the best option for your business.

Maximising Your Grant Benefits

- Plan Multiple Applications

Companies can put in more than one PSG application depending on business needs. You can apply for different solutions to address various business needs – just ensure they don't overlap. - Use SkillsFuture Enterprise Credit (SFEC)

If your organisation is making use of a grant like PSG or EDG, you may also be eligible for the SkillsFuture Enterprise Credit (SFEC), which can cover up to 90% of out-of-pocket expenses on qualifying costs for supportable initiatives. This means that if the PSG supports 50% of the total cost of a project, SFEC can support up to 90% of the remaining fees. No application is necessary, your Corpass administration will be notified if your business qualifies to make use of the credits. - Bundle Related Solutions

Consider applying for complementary solutions simultaneously. For example, pair accounting software with inventory management for comprehensive business digitalisation. - Time Your Applications

Strategically Avoid peak periods like year-end when processing might be slower. Submit applications early in the year for faster processing.

Final Tips for Success

- Do Your Homework: Research thoroughly before choosing solutions. Read reviews, request demos, and ensure the solution genuinely addresses your business needs.

- Engage Early: Contact vendors early to understand their offerings and pricing. This helps avoid last-minute rushes that could lead to mistakes.

- Keep Records: Document everything from initial vendor discussions to implementation photos. Comprehensive records make claim submission smoother.

- Stay Updated: Grant criteria and support levels can change. Check the official EnterpriseSG website regularly for updates. You can also check the PSG FAQ page for detailed answers to specific questions.

- Seek Help When Needed: You may speak to business advisors at our SME Centres for advice on business upgrading. These centres offer free consultations to guide you through the process. Find your nearest SME Centre here.

Ready to Unlock Your Path to Affordable Business Solutions?

The PSG grant represents a significant opportunity for Singapore SMEs to embrace digital transformation without bearing the full financial burden. With up to 50% funding support for pre-approved solutions, it's designed to make technology adoption accessible and affordable.

Remember, the key to success lies in careful preparation, choosing the right solutions, and following the application process meticulously. Don't let the paperwork intimidate you – thousands of SMEs have successfully leveraged PSG to transform their operations.

Start by identifying one area of your business that needs improvement, find a corresponding PSG solution, and take that first step. The digital transformation journey might seem daunting, but with PSG support, you're not walking alone.

Ready to apply? Visit the GoBusiness portal today and explore the pre-approved solutions available for your industry. Your business transformation could be just one application away.

Related Articles

7 Common Mistakes First-Time F&B Owners Make (And How to Avoid Them)

Many first-time F&B owners dive in with passion but overlook key fundamentals. Here are seven common mistakes and practical ways to avoid them for a smoother path to success.

Your Ultimate Checklist for Opening a Cafe in Singapore

Opening a café in Singapore involves detailed planning and compliance with various regulations. This checklist helps guide you through all essential stages—from developing your concept to launching your café—so that no important step is overlooked.

Boosting Supplier Resilience: A Practical Guide for Small Businesses in Singapore

Strong supplier relationships are vital for smooth operations and healthy profit margins. Learn how effective supplier management can help small retailers and F&B businesses in Singapore ensure consistency, quality, and growth.

Accelerate Your Business

All-in Business 5G+ SIM Only Plan

Made Easy and Secure

Keep connected to your business in SG and overseas securely with roaming data & mobile protect.

Customer Engagement

Made Easy

Engage and identify your best and most profitable customers to boost retention.

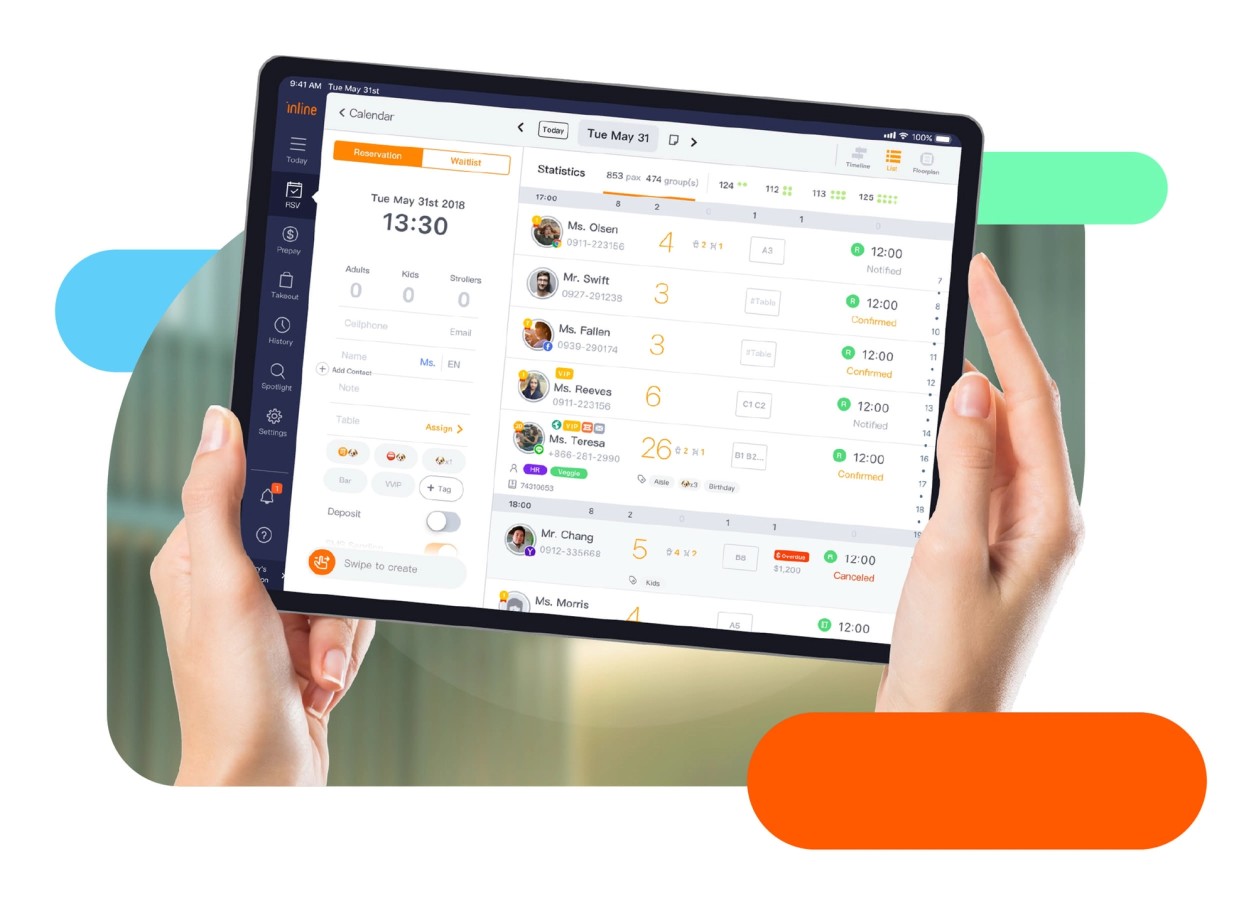

Table Management

Made Easy

From first click to final bill, manage bookings, tables, and guests with ease.